Mortgage finance

FG to seize mortgaged property of retirees over unpaid housing loans

FG to seize mortgaged property of retirees over unpaid housing loans

The Federal Government has announced plans to seize mortgaged properties from retired civil servants who failed to fully repay housing loans obtained during their service.

The move was disclosed in a statement on Thursday by Mrs. Ngozi Obiechina, Head of Information and Public Relations at the Federal Government Staff Housing Loans Board (FGSHLB), quoting the Board’s Executive Secretary, Mrs. Salamatu Ahmed.

She said the initiative is part of efforts to recover outstanding loans and enforce mortgage terms.

The decision follows a recent memo from the Office of the Head of the Civil Service, reminding workers that obtaining a Certificate of Non-Indebtedness from the FGSHLB and MDA Cooperatives is a condition for retirement.

She added that retirees who fail to settle their debts risk losing their mortgaged properties, as the Board is empowered to take legal action under Public Service Rule 021002 (p), which mandates loan clearance before exit from service.

“I am directed to bring to your attention the provision of Public Service Rule (PSR) 021002 (p), which mandates all public servants to obtain a Certificate of Non-Indebtedness as a prerequisite for retirement.”

“The Federal Government will commence the seizure of mortgaged properties belonging to retiring federal public servants who have failed to fully repay housing loans obtained from the board,” Ahmed said.

She noted that the directive also extends to already retired officers who remain indebted, advising them to regularise their loan status and obtain the necessary clearance certificate. She reaffirmed the Board’s commitment to enforcing compliance and pursuing loan recovery through appropriate legal and administrative channels.

What you should know

The Federal Government Staff Housing Loans Board (FGSHLB) was established to facilitate home ownership for federal civil servants through structured loan schemes. However, the board has continued to face challenges in recovering loans, particularly from retired beneficiaries.

The latest enforcement effort reflects growing concern over the backlog of unpaid loans, which may affect the board’s ability to extend housing support to serving civil servants.

Following the latest enforcement effort of the board, the requirement for a Certificate of Non-Indebtedness will be increasingly enforced across federal MDAs as part of broader efforts to promote fiscal responsibility and safeguard public resources.

The FGSHLB’s action highlights its renewed commitment to loan recovery, including from retired officers.

Mortgage finance

Comparing Nigerian Mortgage Structures to Global Standards mortgage

Comparing Nigerian Mortgage Structures to Global Standards

mortgage

The mortgage industry serves as a crucial pillar in fostering homeownership, economic stability, and urban development worldwide. While the basic concept of mortgages remains consistent—providing loans to individuals to buy homes—the structures, regulations, and accessibility of mortgage systems vary significantly from one country to another. Nigeria’s mortgage structure offers unique insights, especially when compared to global standards. This article explores these differences, highlighting the challenges and opportunities within Nigeria’s mortgage system while drawing lessons from international best practices.

The mortgage industry serves as a crucial pillar in fostering homeownership, economic stability, and urban development worldwide. While the basic concept of mortgages remains consistent—providing loans to individuals to buy homes—the structures, regulations, and accessibility of mortgage systems vary significantly from one country to another. Nigeria’s mortgage structure offers unique insights, especially when compared to global standards. This article explores these differences, highlighting the challenges and opportunities within Nigeria’s mortgage system while drawing lessons from international best practices.

Overview of Nigerian Mortgage Structures

Nigeria’s mortgage system is primarily overseen by the Federal Mortgage Bank of Nigeria (FMBN), alongside commercial banks and primary mortgage institutions (PMIs). The key components of the system include:

National Housing Fund (NHF): Established in 1992, the NHF serves as a mandatory savings scheme where employees contribute 2.5% of their monthly salaries. Contributors can access low-interest mortgage loans through the fund.

Interest Rates: Mortgage interest rates in Nigeria typically range from 6% to 25%, depending on the institution and funding source. NHF loans are offered at subsidized rates of about 6%, whereas commercial mortgages attract much higher rates due to risk and inflation considerations.

Loan Tenure: Loan tenures in Nigeria usually span 5 to 20 years, with shorter tenures compared to developed countries. This limits affordability for many prospective homeowners.

Access and Eligibility:

Access to mortgages in Nigeria is constrained by high-interest rates, stringent collateral requirements, and insufficient credit infrastructure. This has resulted in a low mortgage penetration rate of less than 1% of GDP, compared to 50%-70% in advanced economies.

Comparing Global Standards

Interest Rates and Affordability

Globally, mortgage interest rates are influenced by central bank policies, inflation, and economic conditions. Developed nations such as the United States, Canada, and the United Kingdom offer relatively low-interest rates, typically between 2% and 6%. These low rates are supported by stable macroeconomic environments and robust financial markets. Conversely, Nigeria’s high inflation and macroeconomic instability contribute to elevated mortgage rates, reducing affordability for average citizens.

Loan Tenure

Longer loan tenures in advanced economies—often exceeding 30 years—help make monthly payments more affordable, enabling more people to access homeownership. In contrast, Nigeria’s shorter loan tenures increase the financial burden on borrowers, deterring participation in the mortgage market.

Credit Infrastructure

Developed countries have advanced credit scoring systems and frameworks that assess borrowers’ creditworthiness. This transparency reduces risk for lenders and broadens access to mortgage products. Nigeria, however, struggles with inadequate credit reporting systems and high default risks, further limiting mortgage availability.

Government Support and Policies

Countries with well-established mortgage markets benefit from government-backed initiatives. For example, the United States has Fannie Mae and Freddie Mac, which provide liquidity and stability to the housing finance market. Similarly, Canada’s Canada Mortgage and Housing Corporation (CMHC) ensures mortgage affordability and availability. In Nigeria, while the FMBN plays a central role, its resources and impact are limited, leaving significant gaps in housing finance.

Challenges in Nigeria’s Mortgage System

High Construction Costs: The cost of building materials and inadequate infrastructure make home construction expensive, exacerbating affordability issues.

Limited Secondary Market: Unlike developed nations with thriving secondary mortgage markets that provide liquidity, Nigeria lacks a well-functioning secondary market.

Low Housing Supply: An estimated housing deficit of over 20 million units hampers the effectiveness of the mortgage system, as demand far exceeds supply.

Macroeconomic Instability: Currency volatility, inflation, and inconsistent policies discourage long-term lending and investment in the housing sector.

Opportunities and Lessons from Global Best Practices

Developing a Secondary Mortgage Market: Establishing institutions similar to Fannie Mae or Freddie Mac could enhance liquidity in Nigeria’s mortgage market, enabling lenders to issue more loans.

Innovative Financing Models: Embracing alternative financing options such as rent-to-own schemes, micro-mortgages, and Islamic financing could expand access to affordable housing.

Strengthening Credit Infrastructure: Building robust credit reporting systems and financial literacy programs can improve trust between lenders and borrowers.

Government Incentives: Policies like tax incentives for developers, subsidies for low-income households, and reduced import duties on construction materials can stimulate growth in the housing sector.

Conclusion

Nigeria’s mortgage structure faces significant hurdles, including high-interest rates, short loan tenures, and inadequate housing supply. However, by adopting global best practices and tailoring them to local contexts, Nigeria can unlock the potential of its mortgage industry. Developing a robust and inclusive mortgage system is not just a financial imperative but a critical step toward addressing the country’s housing deficit and improving the quality of life for millions of Nigerians

Events

The man who saved thousands of people from HIV

Build Your Website in Minutes with One-Click Import – No Coding Hassle!

In the dynamic world of WordPress, we emerge as a beacon of innovation and excellence. Our popular products, like CoverNews, ChromeNews, Newsphere, and Shopical, alongside powerful plugins such as WP Post Author, Blockspare, and Elespare, serve as the building blocks of your digital journey.

We’re passionate about quality code and elegant design, ensuring your website creation is an effortless blend of sophistication and simplicity. With unwavering support from our dedicated team, you’re never alone.

Templatespare: Create Your Dream Website with Easy Starter Sites!

A beautiful collection of Ready to Import Starter Sites with just one click. Get modern & creative websites in minutes!

Newspaper, Magazine, Blog, and eCommerce Ready

Forget About Starting From Scratch

Explore a world of creativity with 365+ ready-to-use website templates! From chic blogs to dynamic news platforms, engaging magazines, and professional agency websites – find your perfect online space!

One Click Import: No Coding Hassle! Three Simple Steps

Embark on your website journey with simplicity and style. Follow these 3 easy steps to create your online masterpiece effortlessly

- Choose a Site

Explore a rich selection of over 350 pre-built websites. With a single click, import the site that resonates with your vision. - Customize & Personalize

Unleash your creativity! Customize your chosen site with complete design freedom. Tailor every element to build and personalize your website exactly the way you envision it. - Publish & Go Live!

With the editing and customization complete, it’s time to go live! In just minutes, your website will be ready to share with the world.

Join the AF themes family, where excellence meets ease. Explore the endless possibilities and embark on your web journey with us today!

Together, we’re shaping the future of the web.

-

News10 months ago

News10 months agoRERAPAN Celebrates Babatunde Adeyemo at 46

-

News9 months ago

News9 months agoReal Estate Achievers Awards and Exhibition 2025 (REAA)

-

Real Estate Achievers Awards10 months ago

Real Estate Achievers Awards10 months agoReal Estate Achievers Awards and Exhibition 2025

-

News10 months ago

News10 months agoLand Prices in Lekki, Ajah, and Ikoyi: A 2025 Guide for Investors

-

Interviews2 years ago

Interviews2 years agoGoogle hit with record EU fine over Shopping service

-

Mortgage finance10 months ago

Mortgage finance10 months agoComparing Nigerian Mortgage Structures to Global Standards mortgage

-

News9 months ago

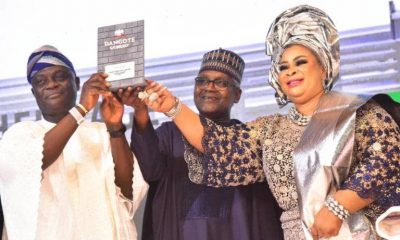

News9 months agoRepton Group wins Dangote Cement National Largest Distributor Award

-

Real Estate insurance2 years ago

Real Estate insurance2 years agoThe full story of Thailand’s extraordinary cave rescue