News

Nigeria’s real estate market: What to expect in 2025

Nigeria’s real estate market: What to expect in 2025

The past year ended with 33% headline inflation and over 200% loss in the Naira value in the last 24 months.

What is happening in Nigeria’s real estate market? Are prices going up or down? Is Lagos still a hotspot for foreign investors? How is Nigeria’s government impacting real estate policies and taxes in 2025?

These are the questions everyone is asking us every day—professionals, buyers, and sellers alike, from Abuja to Port Harcourt and beyond.

Nigeria’s real estate market is one of the most dynamic in Africa. It is driven by a high population growth and a rapid urbanization. The real estate sector had a growth projection of 7.24% in 2024, amounting to a value of $2.14 trillion. By maintaining a similar trajectory, the demand for real estate, particularly in key cities will remain high.

Success in the Nigeria Real Estate would require more than just capital. It will require a careful understanding of the market, good timing, strategic thinking and partnerships that work. Let’s go through a number of things to expect this year 2025.

Boom in residential buildings

Nigeria is staying true to the global trend of rising residential demand. The scale and evolution are unprecedented, ranging from luxury towers to stretched-out villas, multi-family developments and new town projects and more.

This isn’t just about homes — developers have perfected alternative products such as Site and Services, Shell and Core, and Gated community schemes. These create distinct opportunities for increased profitability in real estate business without the necessity to inject more funds.

The driving forces will be Diaspora remittance and urbanization

Many residential buildings will be funded by Nigerians abroad. Due to their unique experience and exposure to luxury we should expect more creative housing delivery solutions to emerge. Internationally branded residences will debut in Lagos, Abuja and some other parts of the country.

Inflation and devaluation: Challenge meets opportunity

The sudden increase in local inflation and foreign exchange levels dominated industry discussions last year. This was bad news for many investors. Yet within these challenges lie a greatest investment opportunity. Just as water always finds its path, consumers will always make ends meet. The exit of many foreign companies has created some investment opportunities.

Health, education and leisure tourism are poised to experience a domestic resurgence. There is likely to be a surge in acquisitions, upgrades and strategic partnerships to develop hospitals, schools, apartments and leisure centres targeted at demand that typically gets this service abroad. The value of naira will consequently improve.

Infrastructure will ease business

The access to infrastructure (especially energy and transportation) will clearly determine the preferred location of factories and industrial parks. This will continue to keep most activities and supply traffic for development concentrated in the old industrial hubs.

SEZs (Special Economic Zones) will remain the popular destinations for new investments. The Lagos Free Zone (Tolaram), Eko Atlantic City, Alaro City and others are at the forefront of these trends. These Public-Private Partnerships (PPPs) are present conditions that reduce the initial risk and challenges of real estate investment and the cost of navigating the complex regulatory environment.

Business operators will seek for stability, reduced operational cost and a shock-proof supply chain more than ever to remain profitable amidst competition.

Facilities management: Rise of property technology

Facilities Management & Maintenance will stand out as an important currency for the property industry. With over 6.9 million sq. ft. of prime offices and retail stock and as the cost of newer buildings sky-rocket, how to maintain older infrastructure will become a significant competitive factor. A well maintained infrastructure will retain its economic value throughout its lifetime.

Despite the economic challenges there is a growing appetite of property end-users for experiential amenities, luxury and class. This will compel investors to prioritize maintaining highly functional services.

Stricter building regulations will raise construction costs, affecting property prices

As a result of the high incidence of building failures experienced in 2024 there will be stricter building regulations in some major cities in the country. These stricter measures will make our houses safer but more expensive.

The price of steel rods, which are essential materials for construction, has gone up. This isn’t just a random spike; it’s partly because builders now have to meet new, tougher standards. When materials cost more, developers don’t just absorb the hit—they pass it on to buyers. So, if you’re looking to buy, expect to see property prices rise as a result.

It is not just materials that are getting pricier. Stricter rules from building regulators will also mean higher operational costs for construction companies. Think about skilled labour and transportation—both are getting more expensive, thanks to factors like exchange rates and inflation. The depreciation of the naira over that of its fellow West African countries has led to the exit of many expatriate semi-skilled building professionals (carpenters, masons etc.). All these factors combined will push property prices up. The federal government has however embarked on massive training of these artisans to cushion this effect.

Abuja under the current government is buzzing with new infrastructure projects, thanks to a boost in government spending. The federal government has approved a total of N159.5 billion for five major projects aimed at enhancing road networks, transportation, and estate access across the Federal Capital Territory (FCT

In 2023, the Federal Capital Executive Council gave the green light to contracts worth N33.24 billion for key projects, focusing on transportation and housing. These developments are set to transform the city, making it more appealing for both residents and businesses. One of the standout projects is the Abuja/Kaduna/Zaria/Kano road rehabilitation, which is expected to be completed by 2025. This road will significantly enhance connectivity, making travel smoother and faster.

With better roads and transport, Abuja will become a hotspot for property seekers. The demand for homes and commercial spaces will rise, driven by factors like population growth and urbanization.

The government’s focus on these improvements will attract more people and businesses to the Abuja and its neighbourhood. This influx is expected to continue pushing property prices upward, making it a good investment destination.

Trump policies

Economic experts think that Trump’s policies will be consistent with strengthening the US economy, having a stronger dollar and maintaining continued strength in US equities. Without doubt, I expect general economic activities to increase in the US as he would likely borrow more and increase government spending.

However, there will be two potential impacts on Nigerians living in the US. If US residential prices increase, they would likely spend their excess income on acquiring more real estate in the US as opposed to investing in Nigeria. On the flip side, Trump’s insistence on deportation of illegal immigrants may see some Nigerians returning home to invest their savings and start all over again. There is no place like home.

But prices aren’t coming down

Property prices are not going to come down in 2025. The provision of cheaper mortgages, reduced interest rates, availability of funding will still take a few years before it can start to significantly affect real estate prices. Demand is still too strong and far ahead of supply due to increased urbanization. Limited infrastructure in areas people want to live, and slow and inadequate supply of new homes in these areas would continue to marginally push property prices up this year or at best, keep it stable.

The Gen Xers are coming back home

Nigerians living abroad who are already in their 50s/60s are likely going to start the wave of ‘Japada’ not just due to the return of Trump to the White House, but also as they are now empty nesters and have excess cash. They will be looking for retirement estates, homes to live in. Homes in Nigeria would become more affordable and attractive to them. Location, security, neighbourhood infrastructure and functionality of the homes in terms of services and spaces will guide their decision on which estate to buy into.

•Okonkwo is an educator and entrepreneur. -culled from – (Nation)

News

Adron Homes Introduces Special Ramadan Offer with Discounts and Gift Rewards

Adron Homes Introduces Special Ramadan Offer with Discounts and Gift Rewards

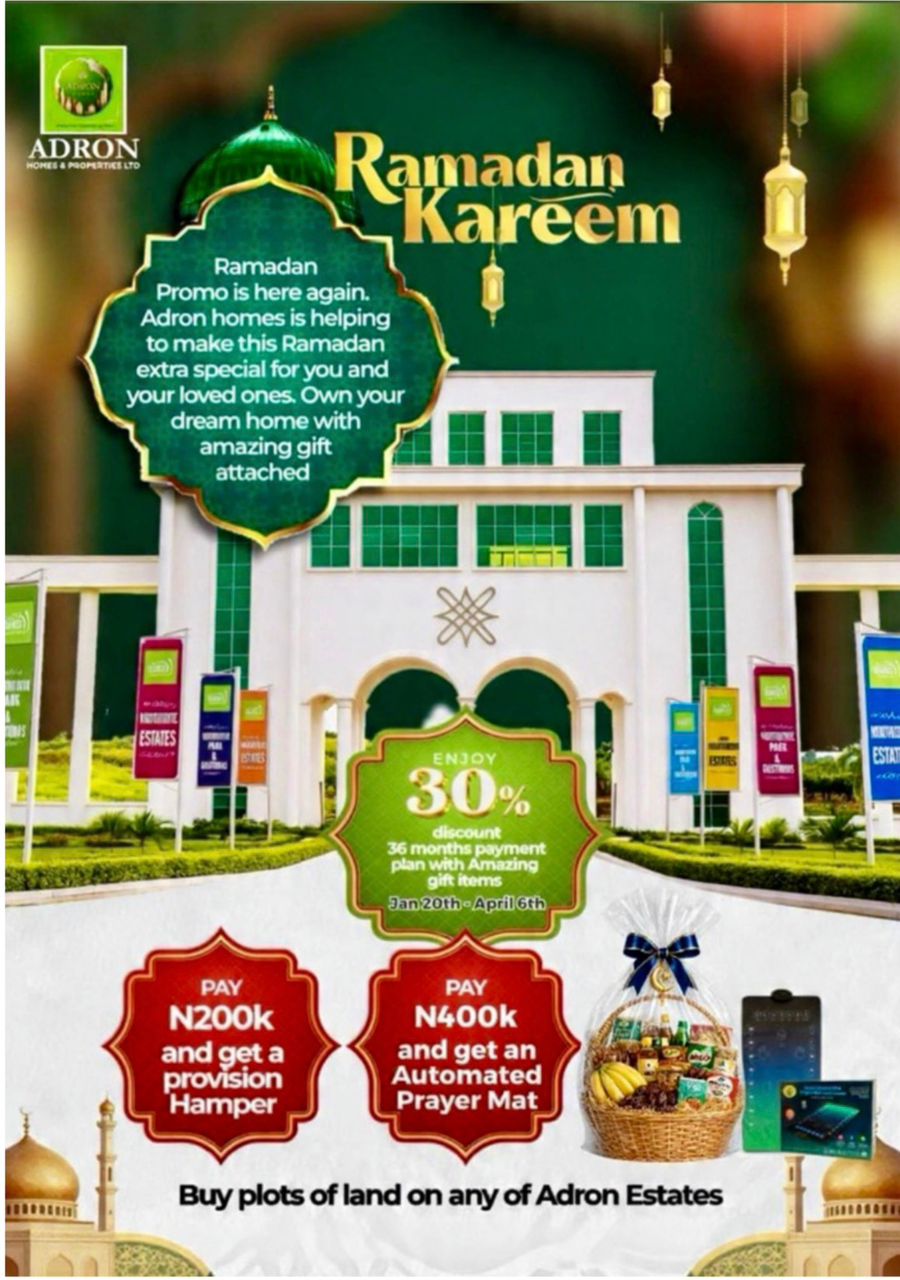

As the holy month of Ramadan inspires reflection, sacrifice, and generosity, Adron Homes and Properties Limited has unveiled its special Ramadan Promo, encouraging families, investors, and aspiring homeowners to move beyond seasonal gestures and embrace property ownership as a lasting investment in their future.

The company stated that the Ramadan campaign, running from January 20th to April 6th, 2026, is designed to help Nigerians build long-term value and stability through accessible real estate opportunities. The initiative offers generous discounts, flexible payment structures, and meaningful Ramadan-themed gifts across its estates and housing projects nationwide.

Under the promo structure, clients enjoy a 30% discount on land purchases alongside a convenient 36-month flexible payment plan, making ownership more affordable and stress-free.

In the spirit of the season, the company has also attached thoughtful rewards to qualifying payments. Clients who pay ₦200,000 receive a Provision Hamper to support their household during the fasting period, while those who pay ₦400,000 receive an Automated Prayer Mat to enhance their spiritual experience throughout Ramadan.

According to the company, the Ramadan Promo reflects its commitment to aligning lifestyle, faith, and financial growth, enabling Nigerians at home and in the diaspora to secure appreciating assets while observing a season centered on discipline and forward planning.

Reiterating its dedication to secure land titles, prime locations, and affordable pricing, Adron Homes urged prospective buyers to take advantage of the limited-time Ramadan campaign to build a future grounded in stability, prosperity, and generational wealth.

This promo covers estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger states.

As Ramadan calls for purposeful living and wise decisions, Adron Homes is redefining the season, transforming reflection into investment and faith into a lasting legacy.

News

Ramadan: Adron Homes Felicitates Muslims, Preaches Hope and Unity

Ramadan: Adron Homes Felicitates Muslims, Preaches Hope and Unity

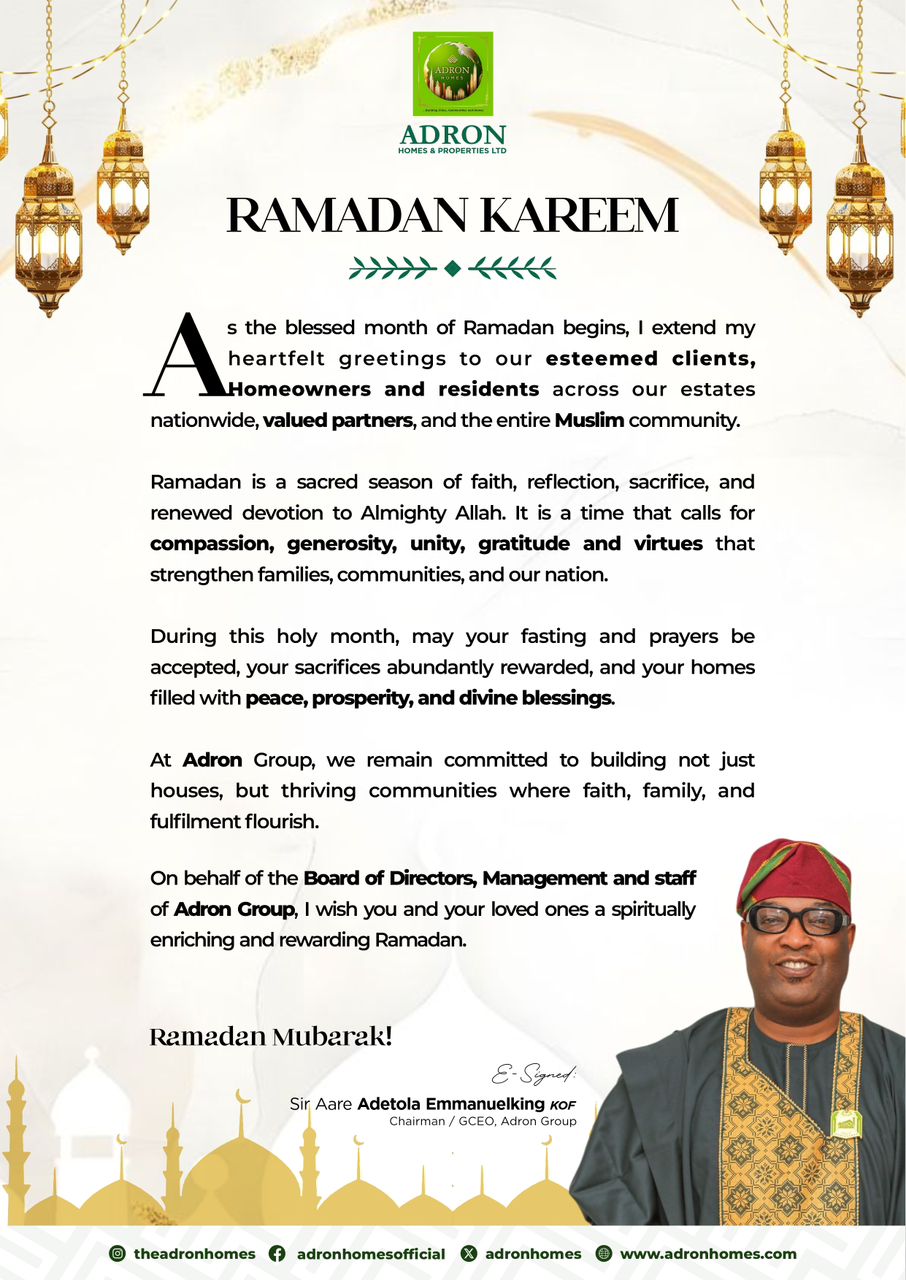

Adron Homes & Properties Limited has congratulated Muslim faithful on the commencement of the holy month of Ramadan, urging Nigerians to embrace the virtues of sacrifice, discipline, and compassion that define the season.

In a statement made available to journalists, the company described Ramadan as a period of deep reflection, spiritual renewal, and strengthened devotion to faith and humanity.

According to the management, the holy month represents values that align with the organisation’s commitment to integrity, resilience, and community development.

“Ramadan is a time that teaches patience, generosity, and selflessness. As our Muslim customers and partners begin the fast, we pray that their sacrifices are accepted and that the season brings peace, joy, and renewed hope to their homes and the nation at large,” the statement read.

The firm reaffirmed its dedication to providing affordable and accessible housing solutions to Nigerians, noting that building homes goes beyond structures to creating environments where families can thrive.

Adron Homes further urged citizens to use the period to pray for national unity, economic stability, and sustainable growth.

It wished all Muslim faithful a spiritually fulfilling Ramadan.

Ramadan Mubarak.

News

Valentine Season: Adron Homes Encourages Nigerians to Build Lasting Love Through Real Estate

Valentine Season: Adron Homes Encourages Nigerians to Build Lasting Love Through Real Estate

Adron Homes and Properties has continued its ongoing “Love for Love Promo” as part of its Valentine season initiatives, encouraging couples, families, and investors to move beyond traditional gifts by embracing shared property ownership as a lasting expression of commitment and financial stability.

The company stated that the promo, which has been running throughout the Valentine period, was designed to inspire Nigerians to build long-term value and legacy through real estate investments. It noted that the initiative offers attractive discounts, flexible payment options, and a variety of exclusive gift items across its estates and housing projects nationwide.

Under the promo structure, clients who pay ₦100,000 receive cake, chocolates, and a bottle of wine, while those who pay ₦200,000 receive a Love Hamper. Subscribers who commit ₦500,000 receive a Love Hamper with cake, and those who pay ₦1,000,000 enjoy a choice of a Samsung phone or a Love Hamper with cake.

The incentives increase with higher commitments. Clients who pay ₦5,000,000 receive either an iPad or a romantic couple’s getaway at a top Nigerian hotel, while payments of ₦10,000,000 come with options including a Samsung Z Fold 7, a three-night stay at a premium resort, or a full solar power installation.

High-value investors are also rewarded, as clients who pay ₦30,000,000 on land receive a three-night couple’s trip to Doha or South Africa. At the same time, purchasers of houses valued at ₦50,000,000 are presented with a double-door refrigerator, further reflecting the company’s focus on combining lifestyle experiences with strategic investments.

The company added that the promo covers estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger states. It reiterated its commitment to secure land titles, affordable pricing, and prime locations, urging Nigerians at home and in the diaspora to take advantage of the ongoing Valentine campaign to build a future rooted in love, security, and prosperity.

-

News10 months ago

News10 months agoRERAPAN Celebrates Babatunde Adeyemo at 46

-

News9 months ago

News9 months agoReal Estate Achievers Awards and Exhibition 2025 (REAA)

-

Real Estate Achievers Awards10 months ago

Real Estate Achievers Awards10 months agoReal Estate Achievers Awards and Exhibition 2025

-

News10 months ago

News10 months agoLand Prices in Lekki, Ajah, and Ikoyi: A 2025 Guide for Investors

-

Interviews2 years ago

Interviews2 years agoGoogle hit with record EU fine over Shopping service

-

Mortgage finance10 months ago

Mortgage finance10 months agoComparing Nigerian Mortgage Structures to Global Standards mortgage

-

News9 months ago

News9 months agoRepton Group wins Dangote Cement National Largest Distributor Award

-

Real Estate insurance2 years ago

Real Estate insurance2 years agoThe full story of Thailand’s extraordinary cave rescue