News

Quest for affordable housing in a changing real estate market

Quest for affordable housing in a changing real estate market

Developers and builders are actively adapting to the evolving real estate market by embracing innovative strategies and responding to emerging trends

As global real estate markets face shifting dynamics from economic pressures to evolving consumer needs, builders are rethinking their strategies to stay afloat and remain competitive.

In recent years, rising inflation, interest rate fluctuations, and increased construction costs have forced developers to reconsider traditional models. The CBN’s monetary policy, particularly the monetary policy rate (MPR), about 27.5 per cent, makes lending unattractive. But rather than slow down, many are innovating.

The fluctuating forex rates have also created high inflation on building materials, which inevitably are being passed to buyers.

The situation has created pockets of private sector estate developers, especially in the urban areas where the housing deficit is pronounced, like in Lagos, Abuja, Port Harcourt and Kano.

and Epe axis in Lagos. In these places, two and three-bedroom flats are selling between N50 – N80 million.

There is also a growing trend of shared apartments, where instead of the usual bungalows in a plot, developers have resorted to smaller apartments such as one or two-bedroom flats that would sell between N50-100 million, making it affordable for the middle class to live in a middle-class environment even though they don’t get the luxury of space and privacy in a compound.

Also, developers have moved outside the traditional cities like Lagos, Abuja, and Port Harcourt market into other state capitals to buy and sell plots of land under site and service scheme at a price considered affordable to the mass market.

On the larger scale at the government level, housing is still witnessing the usual lack of willpower by successive governments, which has continued to increase the supposedly housing deficit across the country.

Environmental concerns and a growing demand for affordable housing are prompting a shift toward greener and more cost-effective construction. Developers are prioritising eco-friendly designs and energy-efficient technologies to meet the growing demand for sustainable living.

construction costs and fluctuating access to financing have pushed many builders to phase projects more cautiously or pursue public-private partnerships.

Tightening building regulations and zoning laws are also reshaping project designs. Builders now engage more with policymakers to ensure compliance and predict future trends.

As the real estate landscape continues to evolve, experts and developers said builders who adapt quickly—with a focus on innovation, sustainability, and efficiency—are most likely to thrive in the market.

In his assessment, the Executive Secretary, Association of Housing Corporation of Nigeria (AHCN), Mr Toye Eniola, said, “This fluctuation in forex market dissuades developers from going for foreign loans as local banks are not ready to give out long-term loans for development; and if they do at high interest rate of over 30 per cent.

According to him, “No developer can lend at this rate to develop and break even as cost of the end product will be on top of the roof, which potential buyers would find difficult to afford.

He said the effect of this is a slow and snail-like development across various sites across the country. “There are rarely new developments,” he said. “This is seriously affecting the growth of the real estate industry as many are struggling to survive; large and mass developments are gradually going out of fashion as developers now develop on need-based and off-takers down-payment.”

Eniola explained that the current situation mostly affects the low and medium income. “This segment of the market ought to be taken care of by the government through housing corporations, but unfortunately, many of the state housing corporations are not getting the needed support from their governments.

“The solution lies in government going back to basics – embarking on social housing through state housing corporations to arrest the rising housing deficit. The government needs to provide infrastructure and support housing corporations to secure facilities for development and subsidise rental or purchasing cost to assist buyers or occupants,” he added.

A private sector practitioner and professional builder, Chucks Omeife, said one has had to think outside the box to cope with the prevailing economic situation, which is unfriendly.

Omeife, a past president of the Nigeria Institute of Building (NIOB), said, “The normal area where patronage is expected has been hijacked by our politicians for obvious reasons; hence, survival in the real estate sector demands critical and all-inclusive thinking.

However, he said opportunities still exist where professionals can depend for some level of survival such as Joint Venture development, Public Private Partnership (PPP), Build Operate and Transfer (BOT) and Renovate Operate and Transfer (ROT).

Omeife, who is the Managing Director of Build Consult Ltd, said, “While the problem of housing provision has been with us, no serious effort has been put in place by successive government to address this issue due to lack of will power and vision to see housing as an economic development indicator and a measure of economic growth.

“The current regime of astronomical prices of building materials is a major factor affecting the real estate development. The fact that most building materials, especially finished components, are imported and tied to the unstable foreign exchange rate is a big blow to the real estate sector.

“Cost of delivering project has skyrocketed that it is almost double if not triple in some cases. This is one major issue confronting the real estate sector today, and it is not looking as if it will be resolved soon,” he said.

Quest for affordable housing in a changing real estate market

A prototype of the Federal Ministry of Housing and Urban Development’s proposed Hope Cities project.

Developers and builders are actively adapting to the evolving real estate market by embracing innovative strategies and responding to emerging trends, CHINEDUM UWAEGBULAM reports.

As global real estate markets face shifting dynamics from economic pressures to evolving consumer needs, builders are rethinking their strategies to stay afloat and remain competitive.

In recent years, rising inflation, interest rate fluctuations, and increased construction costs have forced developers to reconsider traditional models. The CBN’s monetary policy, particularly the monetary policy rate (MPR), about 27.5 per cent, makes lending unattractive. But rather than slow down, many are innovating.

The fluctuating forex rates have also created high inflation on building materials, which inevitably are being passed to buyers.

The situation has created pockets of private sector estate developers, especially in the urban areas where the housing deficit is pronounced, like in Lagos, Abuja, Port Harcourt and Kano.

The Guardian learnt that new town developments are now ongoing outside the metropolitan city, where land cost is low (affordable). For instance, most developers are looking towards the Abijo, Ibeju-lekki and Epe axis in Lagos. In these places, two and three-bedroom flats are selling between N50 – N80 million.

There is also a growing trend of shared apartments, where instead of the usual bungalows in a plot, developers have resorted to smaller apartments such as one or two-bedroom flats that would sell between N50-100 million, making it affordable for the middle class to live in a middle-class environment even though they don’t get the luxury of space and privacy in a compound.

Also, developers have moved outside the traditional cities like Lagos, Abuja, and Port Harcourt market into other state capitals to buy and sell plots of land under site and service scheme at a price considered affordable to the mass market.

On the larger scale at the government level, housing is still witnessing the usual lack of willpower by successive governments, which has continued to increase the supposedly housing deficit across the country.

Environmental concerns and a growing demand for affordable housing are prompting a shift toward greener and more cost-effective construction. Developers are prioritising eco-friendly designs and energy-efficient technologies to meet the growing demand for sustainable living.

Besides, the COVID-19 pandemic has changed how people live and work, leading to an uptick in mixed-use projects that blend residential, commercial, and recreational spaces. These communities, often designed to reduce commuting and increase convenience, are particularly popular in fast-growing cities.

The Guardian gathered that rising construction costs and fluctuating access to financing have pushed many builders to phase projects more cautiously or pursue public-private partnerships.

Tightening building regulations and zoning laws are also reshaping project designs. Builders now engage more with policymakers to ensure compliance and predict future trends.

As the real estate landscape continues to evolve, experts and developers said builders who adapt quickly—with a focus on innovation, sustainability, and efficiency—are most likely to thrive in the market.

In his assessment, the Executive Secretary, Association of Housing Corporation of Nigeria (AHCN), Mr Toye Eniola, said, “This fluctuation in forex market dissuades developers from going for foreign loans as local banks are not ready to give out long-term loans for development; and if they do at high interest rate of over 30 per cent.

According to him, “No developer can lend at this rate to develop and break even as cost of the end product will be on top of the roof, which potential buyers would find difficult to afford.

He said the effect of this is a slow and snail-like development across various sites across the country. “There are rarely new developments,” he said. “This is seriously affecting the growth of the real estate industry as many are struggling to survive; large and mass developments are gradually going out of fashion as developers now develop on need-based and off-takers down-payment.”

Eniola explained that the current situation mostly affects the low and medium income. “This segment of the market ought to be taken care of by the government through housing corporations, but unfortunately, many of the state housing corporations are not getting the needed support from their governments.

“The solution lies in government going back to basics – embarking on social housing through state housing corporations to arrest the rising housing deficit. The government needs to provide infrastructure and support housing corporations to secure facilities for development and subsidise rental or purchasing cost to assist buyers or occupants,” he added.

A private sector practitioner and professional builder, Chucks Omeife, said one has had to think outside the box to cope with the prevailing economic situation, which is unfriendly.

Related News

CBN targets reduction in transaction costs with PAPSS

Naira redesign: Court strikes out N1b suit against Buhari, Emefiele, CBN

How diaspora investments are reshaping real estate market

Omeife, a past president of the Nigeria Institute of Building (NIOB), said, “The normal area where patronage is expected has been hijacked by our politicians for obvious reasons; hence, survival in the real estate sector demands critical and all-inclusive thinking.

However, he said opportunities still exist where professionals can depend for some level of survival such as Joint Venture development, Public Private Partnership (PPP), Build Operate and Transfer (BOT) and Renovate Operate and Transfer (ROT).

Omeife, who is the Managing Director of Build Consult Ltd, said, “While the problem of housing provision has been with us, no serious effort has been put in place by successive government to address this issue due to lack of will power and vision to see housing as an economic development indicator and a measure of economic growth.

“The current regime of astronomical prices of building materials is a major factor affecting the real estate development. The fact that most building materials, especially finished components, are imported and tied to the unstable foreign exchange rate is a big blow to the real estate sector.

“Cost of delivering project has skyrocketed that it is almost double if not triple in some cases. This is one major issue confronting the real estate sector today, and it is not looking as if it will be resolved soon,” he said.

Omeife stressed that the housing situation is a complex issue and addressing it requires a multi-faceted approach that considers the prevailing economic situation.

He stated that the Nigerian economic data and indices do not always reflect the reality on the ground. While there is an obvious crunch in the Nigerian economy, the general outlook on the real estate situation is the opposite.

“The source of funding obviously should be a thing of interest to the government, but incidentally, the real estate sector has been seen to be a haven for money laundering and corruption. It is becoming confusing seeing the high level of activities in the real estate sector despite the downturn in the economy.”

Omeife called on the government to allocate more resources to housing development and infrastructure and to intensify collaboration with the private sector to increase housing supply and affordability.

Besides, he said the government should provide accessible financing options for low-income earners while offering subsidies and incentives to developers to build affordable housing.

National Housing Programme, and the activities of the finance institutions in the housing sector.”

The Managing Director of Property Vaults Limited, Mr Andy Morkah, agreed that the cost of construction has tripled in some areas, making it expensive to build. “The direct impact of this high cost is a high selling price of the finished properties, thereby making an average property unaffordable for the middle class.”

However, he said the market has witnessed some growth attributable to mass market site-and-service schemes and upper-class developments. Another factor Morkah. mentioned that drove growth in the volume of sales is the impact of realtors.

“The industry has witnessed the establishment of several organised realtors groups whose driving factor is the mouth-watering commissions paid by developers. Members of these groups and other independent freelancers have been bullish in the persuasion of buyers for sales.

He linked the issues in the sector to weak demand for finished properties, lack of affordable and long-term mortgage facilities, a dearth of professionalism amongst real estate developers and poor regulation. “The mortgage industry lacks the right liquidity and pricing to service the mortgage needs of the population.”

Morkah, who is a property developer, disclosed that there has been low yearly sales turnover for most real estate companies doing only house development in the last two years, which led to the high level of abandoned sites, as some developers are unable to continue due to lack of funds.

Despite the development, the real estate industry has expanded significantly as one of the major contributors to the nation’s Gross Domestic Product (GDP) because of the activities of old and stable developers coupled with new entrants at the various state capitals selling sites and service estates.

He emphasised that the current state of the Nigerian real estate market requires a drastic reduction in the general price level, and this can majorly be driven by intentional government economic policies that will improve balance of payment indices towards reversing the exchange rate, among other factors.

He advocates government policies that will intentionally reduce the cost of land acquisition and construction such that allocation of land to developers should be transparent and affordable. “At this period, processing of land titles and building approvals should be at minimal cost to balance already existing high cost of construction.

“Government should invest massively on infrastructure in new areas to encourage developers. The government should remove politics from the allocation of mass housing projects, engage professional developers or partner with them,” he said.

News

Adron Homes Introduces Special Ramadan Offer with Discounts and Gift Rewards

Adron Homes Introduces Special Ramadan Offer with Discounts and Gift Rewards

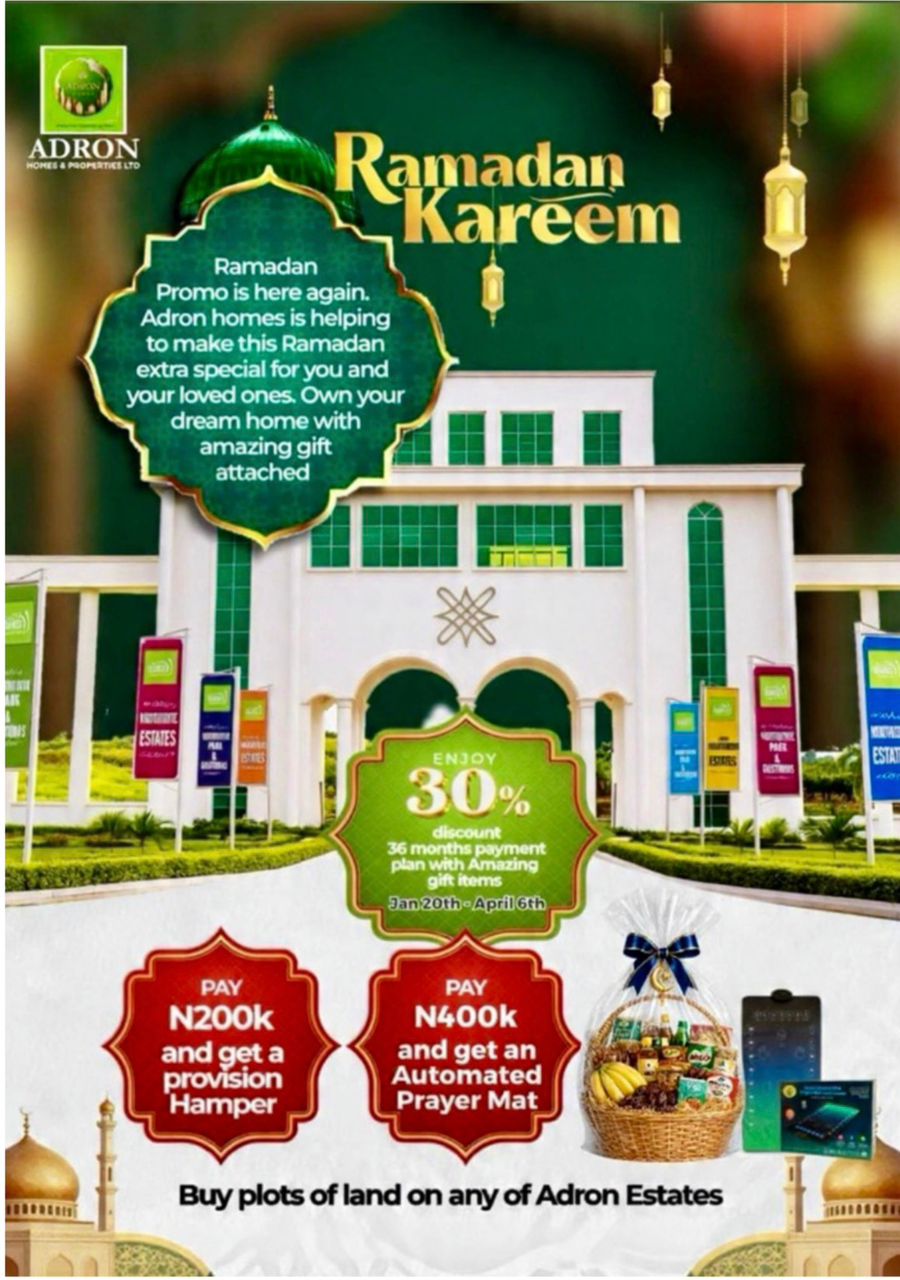

As the holy month of Ramadan inspires reflection, sacrifice, and generosity, Adron Homes and Properties Limited has unveiled its special Ramadan Promo, encouraging families, investors, and aspiring homeowners to move beyond seasonal gestures and embrace property ownership as a lasting investment in their future.

The company stated that the Ramadan campaign, running from January 20th to April 6th, 2026, is designed to help Nigerians build long-term value and stability through accessible real estate opportunities. The initiative offers generous discounts, flexible payment structures, and meaningful Ramadan-themed gifts across its estates and housing projects nationwide.

Under the promo structure, clients enjoy a 30% discount on land purchases alongside a convenient 36-month flexible payment plan, making ownership more affordable and stress-free.

In the spirit of the season, the company has also attached thoughtful rewards to qualifying payments. Clients who pay ₦200,000 receive a Provision Hamper to support their household during the fasting period, while those who pay ₦400,000 receive an Automated Prayer Mat to enhance their spiritual experience throughout Ramadan.

According to the company, the Ramadan Promo reflects its commitment to aligning lifestyle, faith, and financial growth, enabling Nigerians at home and in the diaspora to secure appreciating assets while observing a season centered on discipline and forward planning.

Reiterating its dedication to secure land titles, prime locations, and affordable pricing, Adron Homes urged prospective buyers to take advantage of the limited-time Ramadan campaign to build a future grounded in stability, prosperity, and generational wealth.

This promo covers estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger states.

As Ramadan calls for purposeful living and wise decisions, Adron Homes is redefining the season, transforming reflection into investment and faith into a lasting legacy.

News

Ramadan: Adron Homes Felicitates Muslims, Preaches Hope and Unity

Ramadan: Adron Homes Felicitates Muslims, Preaches Hope and Unity

Adron Homes & Properties Limited has congratulated Muslim faithful on the commencement of the holy month of Ramadan, urging Nigerians to embrace the virtues of sacrifice, discipline, and compassion that define the season.

In a statement made available to journalists, the company described Ramadan as a period of deep reflection, spiritual renewal, and strengthened devotion to faith and humanity.

According to the management, the holy month represents values that align with the organisation’s commitment to integrity, resilience, and community development.

“Ramadan is a time that teaches patience, generosity, and selflessness. As our Muslim customers and partners begin the fast, we pray that their sacrifices are accepted and that the season brings peace, joy, and renewed hope to their homes and the nation at large,” the statement read.

The firm reaffirmed its dedication to providing affordable and accessible housing solutions to Nigerians, noting that building homes goes beyond structures to creating environments where families can thrive.

Adron Homes further urged citizens to use the period to pray for national unity, economic stability, and sustainable growth.

It wished all Muslim faithful a spiritually fulfilling Ramadan.

Ramadan Mubarak.

News

Valentine Season: Adron Homes Encourages Nigerians to Build Lasting Love Through Real Estate

Valentine Season: Adron Homes Encourages Nigerians to Build Lasting Love Through Real Estate

Adron Homes and Properties has continued its ongoing “Love for Love Promo” as part of its Valentine season initiatives, encouraging couples, families, and investors to move beyond traditional gifts by embracing shared property ownership as a lasting expression of commitment and financial stability.

The company stated that the promo, which has been running throughout the Valentine period, was designed to inspire Nigerians to build long-term value and legacy through real estate investments. It noted that the initiative offers attractive discounts, flexible payment options, and a variety of exclusive gift items across its estates and housing projects nationwide.

Under the promo structure, clients who pay ₦100,000 receive cake, chocolates, and a bottle of wine, while those who pay ₦200,000 receive a Love Hamper. Subscribers who commit ₦500,000 receive a Love Hamper with cake, and those who pay ₦1,000,000 enjoy a choice of a Samsung phone or a Love Hamper with cake.

The incentives increase with higher commitments. Clients who pay ₦5,000,000 receive either an iPad or a romantic couple’s getaway at a top Nigerian hotel, while payments of ₦10,000,000 come with options including a Samsung Z Fold 7, a three-night stay at a premium resort, or a full solar power installation.

High-value investors are also rewarded, as clients who pay ₦30,000,000 on land receive a three-night couple’s trip to Doha or South Africa. At the same time, purchasers of houses valued at ₦50,000,000 are presented with a double-door refrigerator, further reflecting the company’s focus on combining lifestyle experiences with strategic investments.

The company added that the promo covers estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger states. It reiterated its commitment to secure land titles, affordable pricing, and prime locations, urging Nigerians at home and in the diaspora to take advantage of the ongoing Valentine campaign to build a future rooted in love, security, and prosperity.

-

News10 months ago

News10 months agoRERAPAN Celebrates Babatunde Adeyemo at 46

-

News9 months ago

News9 months agoReal Estate Achievers Awards and Exhibition 2025 (REAA)

-

Real Estate Achievers Awards10 months ago

Real Estate Achievers Awards10 months agoReal Estate Achievers Awards and Exhibition 2025

-

News10 months ago

News10 months agoLand Prices in Lekki, Ajah, and Ikoyi: A 2025 Guide for Investors

-

Interviews2 years ago

Interviews2 years agoGoogle hit with record EU fine over Shopping service

-

Mortgage finance10 months ago

Mortgage finance10 months agoComparing Nigerian Mortgage Structures to Global Standards mortgage

-

News9 months ago

News9 months agoRepton Group wins Dangote Cement National Largest Distributor Award

-

Real Estate insurance2 years ago

Real Estate insurance2 years agoThe full story of Thailand’s extraordinary cave rescue