News

Comparing Nigerian Mortgage Structures to Global Standards mortgage

Comparing Nigerian Mortgage Structures to Global Standards

mortgage

The mortgage industry serves as a crucial pillar in fostering homeownership, economic stability, and urban development worldwide. While the basic concept of mortgages remains consistent—providing loans to individuals to buy homes—the structures, regulations, and accessibility of mortgage systems vary significantly from one country to another. Nigeria’s mortgage structure offers unique insights, especially when compared to global standards. This article explores these differences, highlighting the challenges and opportunities within Nigeria’s mortgage system while drawing lessons from international best practices.

The mortgage industry serves as a crucial pillar in fostering homeownership, economic stability, and urban development worldwide. While the basic concept of mortgages remains consistent—providing loans to individuals to buy homes—the structures, regulations, and accessibility of mortgage systems vary significantly from one country to another. Nigeria’s mortgage structure offers unique insights, especially when compared to global standards. This article explores these differences, highlighting the challenges and opportunities within Nigeria’s mortgage system while drawing lessons from international best practices.

Overview of Nigerian Mortgage Structures

Nigeria’s mortgage system is primarily overseen by the Federal Mortgage Bank of Nigeria (FMBN), alongside commercial banks and primary mortgage institutions (PMIs). The key components of the system include:

National Housing Fund (NHF): Established in 1992, the NHF serves as a mandatory savings scheme where employees contribute 2.5% of their monthly salaries. Contributors can access low-interest mortgage loans through the fund.

Interest Rates: Mortgage interest rates in Nigeria typically range from 6% to 25%, depending on the institution and funding source. NHF loans are offered at subsidized rates of about 6%, whereas commercial mortgages attract much higher rates due to risk and inflation considerations.

Loan Tenure: Loan tenures in Nigeria usually span 5 to 20 years, with shorter tenures compared to developed countries. This limits affordability for many prospective homeowners.

Access and Eligibility:

Access to mortgages in Nigeria is constrained by high-interest rates, stringent collateral requirements, and insufficient credit infrastructure. This has resulted in a low mortgage penetration rate of less than 1% of GDP, compared to 50%-70% in advanced economies.

Comparing Global Standards

Interest Rates and Affordability

Globally, mortgage interest rates are influenced by central bank policies, inflation, and economic conditions. Developed nations such as the United States, Canada, and the United Kingdom offer relatively low-interest rates, typically between 2% and 6%. These low rates are supported by stable macroeconomic environments and robust financial markets. Conversely, Nigeria’s high inflation and macroeconomic instability contribute to elevated mortgage rates, reducing affordability for average citizens.

Loan Tenure

Longer loan tenures in advanced economies—often exceeding 30 years—help make monthly payments more affordable, enabling more people to access homeownership. In contrast, Nigeria’s shorter loan tenures increase the financial burden on borrowers, deterring participation in the mortgage market.

Credit Infrastructure

Developed countries have advanced credit scoring systems and frameworks that assess borrowers’ creditworthiness. This transparency reduces risk for lenders and broadens access to mortgage products. Nigeria, however, struggles with inadequate credit reporting systems and high default risks, further limiting mortgage availability.

Government Support and Policies

Countries with well-established mortgage markets benefit from government-backed initiatives. For example, the United States has Fannie Mae and Freddie Mac, which provide liquidity and stability to the housing finance market. Similarly, Canada’s Canada Mortgage and Housing Corporation (CMHC) ensures mortgage affordability and availability. In Nigeria, while the FMBN plays a central role, its resources and impact are limited, leaving significant gaps in housing finance.

Challenges in Nigeria’s Mortgage System

High Construction Costs: The cost of building materials and inadequate infrastructure make home construction expensive, exacerbating affordability issues.

Limited Secondary Market: Unlike developed nations with thriving secondary mortgage markets that provide liquidity, Nigeria lacks a well-functioning secondary market.

Low Housing Supply: An estimated housing deficit of over 20 million units hampers the effectiveness of the mortgage system, as demand far exceeds supply.

Macroeconomic Instability: Currency volatility, inflation, and inconsistent policies discourage long-term lending and investment in the housing sector.

Opportunities and Lessons from Global Best Practices

Developing a Secondary Mortgage Market: Establishing institutions similar to Fannie Mae or Freddie Mac could enhance liquidity in Nigeria’s mortgage market, enabling lenders to issue more loans.

Innovative Financing Models: Embracing alternative financing options such as rent-to-own schemes, micro-mortgages, and Islamic financing could expand access to affordable housing.

Strengthening Credit Infrastructure: Building robust credit reporting systems and financial literacy programs can improve trust between lenders and borrowers.

Government Incentives: Policies like tax incentives for developers, subsidies for low-income households, and reduced import duties on construction materials can stimulate growth in the housing sector.

Conclusion

Nigeria’s mortgage structure faces significant hurdles, including high-interest rates, short loan tenures, and inadequate housing supply. However, by adopting global best practices and tailoring them to local contexts, Nigeria can unlock the potential of its mortgage industry. Developing a robust and inclusive mortgage system is not just a financial imperative but a critical step toward addressing the country’s housing deficit and improving the quality of life for millions of Nigerians

News

Adron Homes Introduces Special Ramadan Offer with Discounts and Gift Rewards

Adron Homes Introduces Special Ramadan Offer with Discounts and Gift Rewards

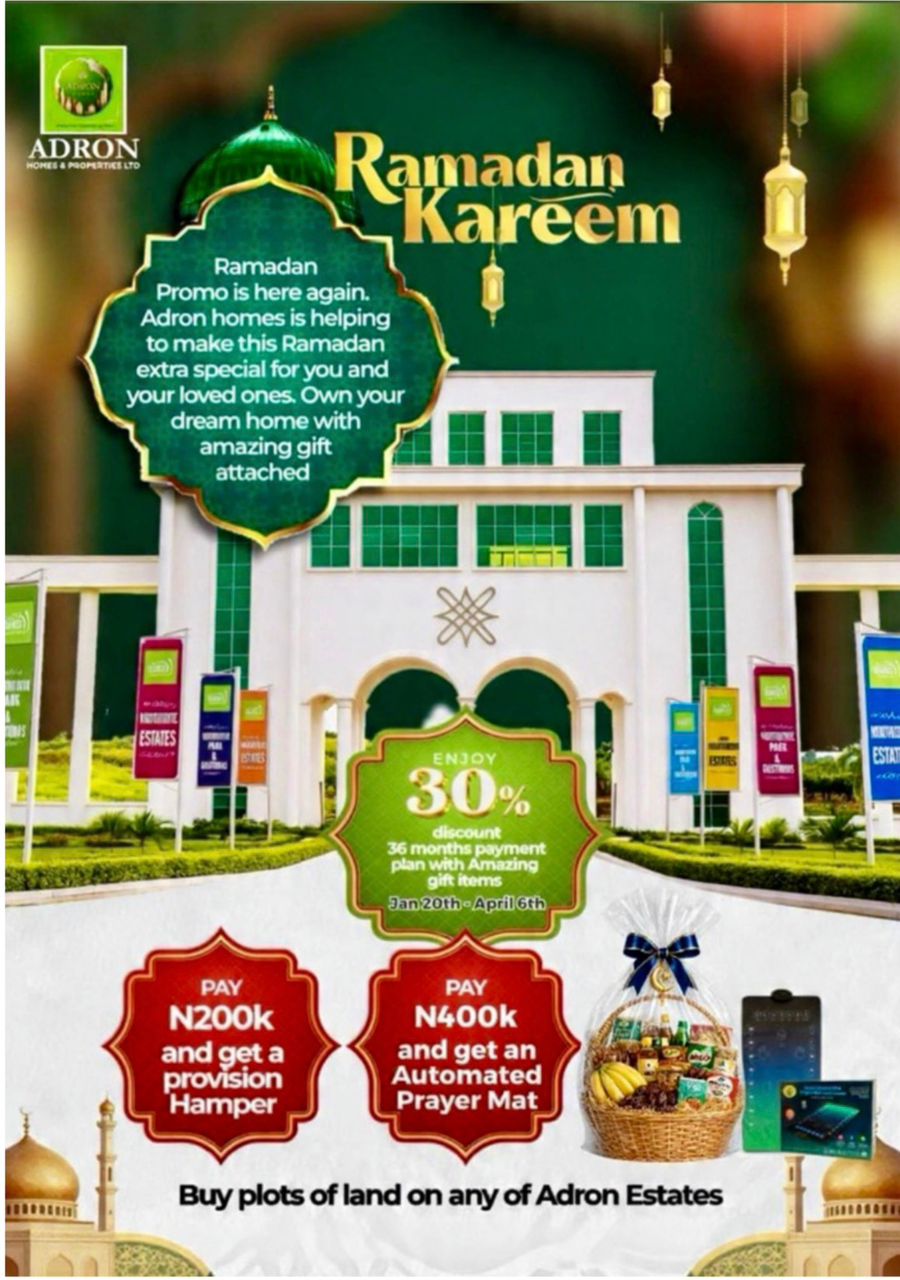

As the holy month of Ramadan inspires reflection, sacrifice, and generosity, Adron Homes and Properties Limited has unveiled its special Ramadan Promo, encouraging families, investors, and aspiring homeowners to move beyond seasonal gestures and embrace property ownership as a lasting investment in their future.

The company stated that the Ramadan campaign, running from January 20th to April 6th, 2026, is designed to help Nigerians build long-term value and stability through accessible real estate opportunities. The initiative offers generous discounts, flexible payment structures, and meaningful Ramadan-themed gifts across its estates and housing projects nationwide.

Under the promo structure, clients enjoy a 30% discount on land purchases alongside a convenient 36-month flexible payment plan, making ownership more affordable and stress-free.

In the spirit of the season, the company has also attached thoughtful rewards to qualifying payments. Clients who pay ₦200,000 receive a Provision Hamper to support their household during the fasting period, while those who pay ₦400,000 receive an Automated Prayer Mat to enhance their spiritual experience throughout Ramadan.

According to the company, the Ramadan Promo reflects its commitment to aligning lifestyle, faith, and financial growth, enabling Nigerians at home and in the diaspora to secure appreciating assets while observing a season centered on discipline and forward planning.

Reiterating its dedication to secure land titles, prime locations, and affordable pricing, Adron Homes urged prospective buyers to take advantage of the limited-time Ramadan campaign to build a future grounded in stability, prosperity, and generational wealth.

This promo covers estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger states.

As Ramadan calls for purposeful living and wise decisions, Adron Homes is redefining the season, transforming reflection into investment and faith into a lasting legacy.

News

Ramadan: Adron Homes Felicitates Muslims, Preaches Hope and Unity

Ramadan: Adron Homes Felicitates Muslims, Preaches Hope and Unity

Adron Homes & Properties Limited has congratulated Muslim faithful on the commencement of the holy month of Ramadan, urging Nigerians to embrace the virtues of sacrifice, discipline, and compassion that define the season.

In a statement made available to journalists, the company described Ramadan as a period of deep reflection, spiritual renewal, and strengthened devotion to faith and humanity.

According to the management, the holy month represents values that align with the organisation’s commitment to integrity, resilience, and community development.

“Ramadan is a time that teaches patience, generosity, and selflessness. As our Muslim customers and partners begin the fast, we pray that their sacrifices are accepted and that the season brings peace, joy, and renewed hope to their homes and the nation at large,” the statement read.

The firm reaffirmed its dedication to providing affordable and accessible housing solutions to Nigerians, noting that building homes goes beyond structures to creating environments where families can thrive.

Adron Homes further urged citizens to use the period to pray for national unity, economic stability, and sustainable growth.

It wished all Muslim faithful a spiritually fulfilling Ramadan.

Ramadan Mubarak.

News

Valentine Season: Adron Homes Encourages Nigerians to Build Lasting Love Through Real Estate

Valentine Season: Adron Homes Encourages Nigerians to Build Lasting Love Through Real Estate

Adron Homes and Properties has continued its ongoing “Love for Love Promo” as part of its Valentine season initiatives, encouraging couples, families, and investors to move beyond traditional gifts by embracing shared property ownership as a lasting expression of commitment and financial stability.

The company stated that the promo, which has been running throughout the Valentine period, was designed to inspire Nigerians to build long-term value and legacy through real estate investments. It noted that the initiative offers attractive discounts, flexible payment options, and a variety of exclusive gift items across its estates and housing projects nationwide.

Under the promo structure, clients who pay ₦100,000 receive cake, chocolates, and a bottle of wine, while those who pay ₦200,000 receive a Love Hamper. Subscribers who commit ₦500,000 receive a Love Hamper with cake, and those who pay ₦1,000,000 enjoy a choice of a Samsung phone or a Love Hamper with cake.

The incentives increase with higher commitments. Clients who pay ₦5,000,000 receive either an iPad or a romantic couple’s getaway at a top Nigerian hotel, while payments of ₦10,000,000 come with options including a Samsung Z Fold 7, a three-night stay at a premium resort, or a full solar power installation.

High-value investors are also rewarded, as clients who pay ₦30,000,000 on land receive a three-night couple’s trip to Doha or South Africa. At the same time, purchasers of houses valued at ₦50,000,000 are presented with a double-door refrigerator, further reflecting the company’s focus on combining lifestyle experiences with strategic investments.

The company added that the promo covers estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger states. It reiterated its commitment to secure land titles, affordable pricing, and prime locations, urging Nigerians at home and in the diaspora to take advantage of the ongoing Valentine campaign to build a future rooted in love, security, and prosperity.

-

News10 months ago

News10 months agoRERAPAN Celebrates Babatunde Adeyemo at 46

-

News9 months ago

News9 months agoReal Estate Achievers Awards and Exhibition 2025 (REAA)

-

Real Estate Achievers Awards10 months ago

Real Estate Achievers Awards10 months agoReal Estate Achievers Awards and Exhibition 2025

-

News10 months ago

News10 months agoLand Prices in Lekki, Ajah, and Ikoyi: A 2025 Guide for Investors

-

Interviews2 years ago

Interviews2 years agoGoogle hit with record EU fine over Shopping service

-

Mortgage finance10 months ago

Mortgage finance10 months agoComparing Nigerian Mortgage Structures to Global Standards mortgage

-

News9 months ago

News9 months agoRepton Group wins Dangote Cement National Largest Distributor Award

-

Real Estate insurance2 years ago

Real Estate insurance2 years agoThe full story of Thailand’s extraordinary cave rescue