News

How diaspora investments are reshaping real estate market

How diaspora investments are reshaping real estate market

Nigerians in diaspora have emerged as a powerful force in the country’s real estate sector, injecting billions of naira yearly into property investments. Their contributions bring higher standards and global perspectives to local real estate practices

A growing number of Nigerians in the diaspora are investing in property back home, driven by emotional ties, rising incomes abroad, and economic uncertainty in host countries.

This trend is reshaping real estate in Nigeria, fueling a construction boom, price surges in certain urban areas, and triggering fraud and legal disputes.

The Central Bank of Nigeria (CBN) reported a significant increase in remittance inflows, reaching $553 million in July 2024, a 130 per cent increase from the corresponding period in 2023. In 2024, diaspora remittances to Nigeria reached $20.93 billion, a significant increase of 8.9 per cent year-on-year

Many remittances were channelled into real estate, as the diaspora seeks to establish a tangible presence back home, whether for retirement, family support, or as a hedge against economic uncertainties abroad.

perties, as well as Ibadan, Enugu, Benin City, Owerri, Uyo, Ilorin and Asaba – emerging cities offering affordability and lower entry thresholds, as well as appreciable returns.

Experts estimate that 70 per cent of investments in Nigeria’s real estate sector originate from the diaspora, highlighting their significant influence on the market. Over the past five years, Nigerians in the diaspora have remitted approximately $99 billion, underscoring their vital role in the nation’s economic development.

The Guardian investigation revealed that many diaspora Nigerians fall victim to scams involving fake land titles, double sales, or properties that don’t exist. Scammers often pose as agents, family members, or even developers. A UK-based Nigerian who sent funds to build a house in Enugu, only to discover that the land didn’t exist or had been resold to another buyer.

Lack of transparency in documentation processes complicates the worries of these Nigerians. Title registration and verification processes are often bureaucratic, slow, and riddled with inconsistencies across states. Buyers abroad can’t verify property ownership or development status in real-time.

Other challenges are that these investors rely on family members or acquaintances who may mismanage funds or give false updates, miscommunication, unfinished buildings, or outright theft, as well as insecurity in parts of Nigeria, especially rural or developing areas, which makes certain regions unattractive. As such, investors stick to “safe zones,” driving up prices in cities like Lagos and Abuja.

Amid the uncertainty and frustration, a new wave of platforms, legal reforms, and tech-driven real estate firms is working to rebuild trust with Nigeria’s diaspora. These solutions aim to offer transparency, accountability, and convenience—critical tools for anyone investing from thousands of miles away.

For instance, platforms are curating listings with verified titles and developer credentials. Some even offer video walk-throughs, digital documentation, and escrow services that hold funds until certain project milestones are met.

Startups are using blockchain technology to digitise and secure land title records, starting with pilot projects in states like Lagos and Oyo. This innovation makes it easier for diaspora investors to confirm land ownership remotely and reduces the risk of fraud.

Firms now offer diaspora-exclusive packages such as flexible payment plans, construction progress monitoring via apps or video updates and delivery guarantees and legal representation for non-resident buyers. Some developers even conduct property road shows in the UK, US, and Canada, allowing Nigerians abroad to meet company reps and sign contracts in person.

Now, the Federal Government, tech platforms and verified developers are stepping in to restore confidence. To cater for the diverse needs of Nigerians and expand access to affordable housing, the Federal Mortgage Bank of Nigeria and Nigerians in Diaspora Commission (NiDCOM) designed the Diaspora Mortgage Loan. The initiative is expected to open opportunities for Nigerians living abroad to invest in real estate back home in Nigeria.

There are ongoing engagements between the bank, NiDCOM and the Central Bank of Nigeria (CBN) aimed at ensuring seamless transaction processes. International Money Transfer Operators (IMTOs) are also being engaged to facilitate smooth transactions, with plans for a full rollout of the product this year.

Related News

Human trafficking: Ghana hands over 231 rescued Nigerians to NiDCOM, NAPTIP

CBN targets reduction in transaction costs with PAPSS

Naira redesign: Court strikes out N1b suit against Buhari, Emefiele, CBN

Experts urged the Federal Government to work to attract more foreign investment, while safeguarding the interests of its diaspora should be a national priority, not just for real estate, but for long-term economic development.

They called for a stronger legal protection, streamlined land registration, and widespread digital verification, as well as smart platforms and transparent developers to end heartbreak in real estate investments.

The Chairman, Lagos branch of the Nigerian Institution of Estate Surveyors and Valuers (NIESV), Mr Gbenga Ismail, admitted that Foreign Direct Investments (FDI), especially from Nigerians in the diaspora, contribute significantly to inflows in real estate.

According to him, the development has increased housing development, especially in urban and semi-urban areas, with a focus on mid- to high-end properties, enabling the rise of real estate tech platforms: Platforms offering virtual tours, online purchases, and escrow services cater to diaspora investors.

It has also improved building standards: Diaspora demands for quality and transparency have influenced developers to adopt better construction practices, boost GDP and employment: construction and related industries benefit from increased demand.

He disclosed that that the investors are motivated by the desire to own property back home, investment opportunities – high returns compared to markets abroad, retirement planning – building or buying homes to return to, family support – providing shelter for relatives or generating rental income and weakened naira – encourages conversion of foreign earnings into real assets.

To curb the risk associated with such investments, Ismail advocated the use of escrow services and verified developers, ensuring funds are only released when project milestones are met, and title verification – Partnering with professionals to verify property documents before purchase.

Other suggestions he made include investment through structured real estate funds or diaspora investment platforms, providing oversight and legal protection, government regulation and incentives, encouraging diaspora-friendly policies and easing land titling processes and the use of digital platforms, promoting transparency through tech tools that allow real-time project tracking and remote property management.

The Chairman, NIESV, Anambra State Branch, Raji Adewale, said the influx of FDI has profoundly redefined the contours of the nation’s real estate ecosystem. “These capital inflows have not only augmented liquidity within the sector but have also ushered in global best practices, modern architectural standards, and an enhanced appetite for structured developments.

“The sector has witnessed a proliferation of high-end residential estates, premium office complexes, and mixed-use developments, particularly in urban epicentres. This renaissance has spurred infrastructural expansion, elevated professional service standards, and bolstered investor confidence, thereby repositioning the real estate market as a cornerstone of national economic growth,” he said.

Adewale noted that motives underpinning diaspora investments are both sentimental and strategic, such as hedging against inflation and currency volatility, the desire to bequeath tangible wealth to descendants, and superior return on investment compared to stagnating overseas markets. He added that enhanced institutional frameworks like improvements in land administration, digital registries, and diaspora-targeted policies have instilled greater confidence.

He called on the government to sanitise the terrain and engender sustainable diaspora participation through digitisation of land records, establishing regulated Real Estate Investment Trusts (REITs), and enforcement of professional ethics to eliminate quackery, as well as accelerated judicial processes to expedite dispute resolution.

“The ascendancy of diaspora investments in Nigeria’s real estate sector is not merely a financial trend—it is a transformative force. With the right safeguards, institutional reforms, and strategic foresight, this capital can serve as a linchpin for sustainable urban development, national economic rejuvenation, and generational wealth creation,” Adewale added.

Former president of the African Chapter of the International Real Estate Federation (FIABCI), Mr Chudi Ubosi, said there has always been interest by corporate investors like the Rendevour in Alaro City in the FTZE in Lagos, but the greatest interest has been from citizens in the diaspora. “The greatest interest in the Nigerian real estate sector is internal. Private investors are reshaping the sector from Lagos to Abuja and nationwide.”

Ubosi explained that the challenges of those investments for companies are usually the inability to repatriate profits, security of investment and a couple of other environmental issues like poor electricity supply. “The risks of investment in Nigeria can be ameliorated purely by good governance and the provision of an enabling environment for businesses to thrive,” he said.

News

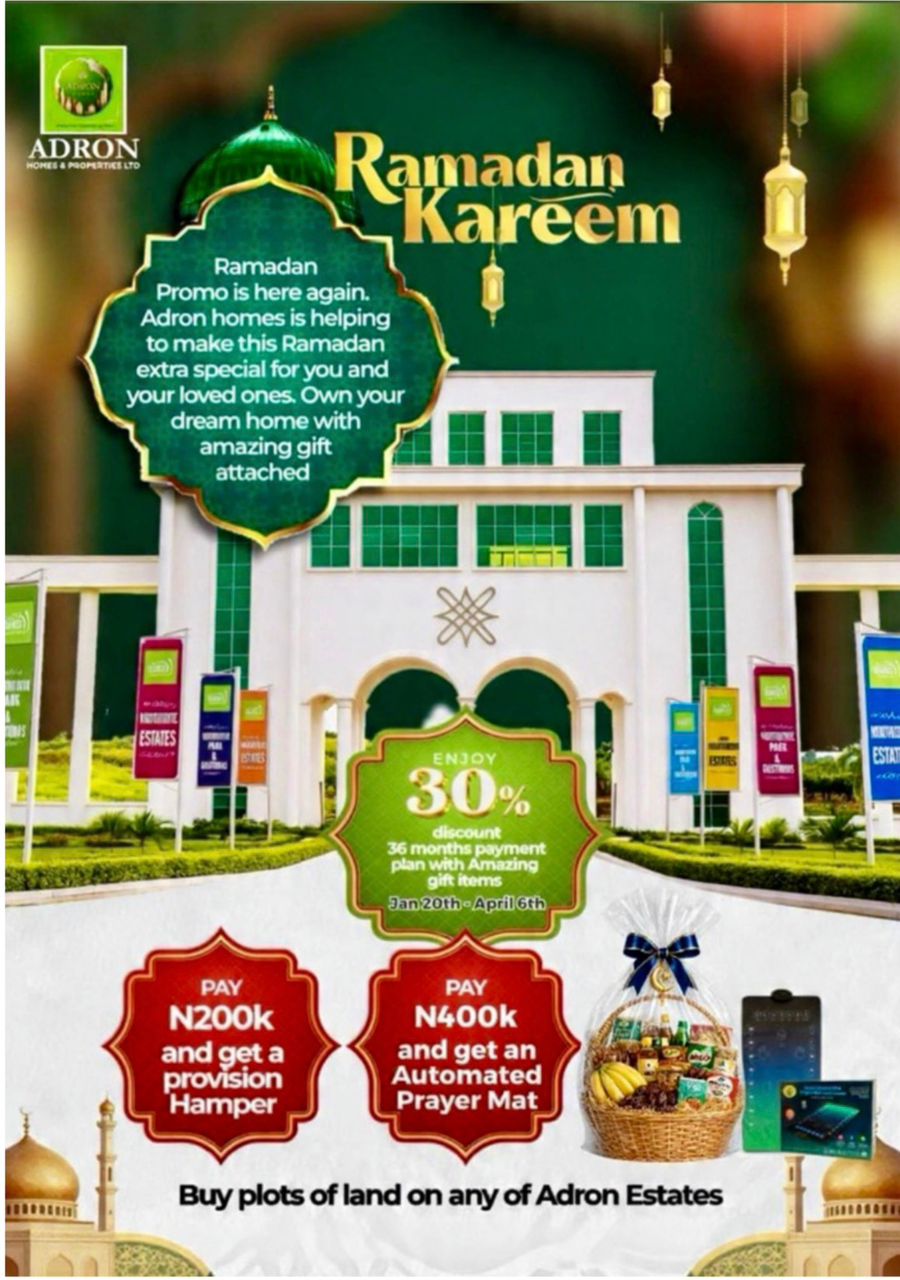

Adron Homes Introduces Special Ramadan Offer with Discounts and Gift Rewards

Adron Homes Introduces Special Ramadan Offer with Discounts and Gift Rewards

As the holy month of Ramadan inspires reflection, sacrifice, and generosity, Adron Homes and Properties Limited has unveiled its special Ramadan Promo, encouraging families, investors, and aspiring homeowners to move beyond seasonal gestures and embrace property ownership as a lasting investment in their future.

The company stated that the Ramadan campaign, running from January 20th to April 6th, 2026, is designed to help Nigerians build long-term value and stability through accessible real estate opportunities. The initiative offers generous discounts, flexible payment structures, and meaningful Ramadan-themed gifts across its estates and housing projects nationwide.

Under the promo structure, clients enjoy a 30% discount on land purchases alongside a convenient 36-month flexible payment plan, making ownership more affordable and stress-free.

In the spirit of the season, the company has also attached thoughtful rewards to qualifying payments. Clients who pay ₦200,000 receive a Provision Hamper to support their household during the fasting period, while those who pay ₦400,000 receive an Automated Prayer Mat to enhance their spiritual experience throughout Ramadan.

According to the company, the Ramadan Promo reflects its commitment to aligning lifestyle, faith, and financial growth, enabling Nigerians at home and in the diaspora to secure appreciating assets while observing a season centered on discipline and forward planning.

Reiterating its dedication to secure land titles, prime locations, and affordable pricing, Adron Homes urged prospective buyers to take advantage of the limited-time Ramadan campaign to build a future grounded in stability, prosperity, and generational wealth.

This promo covers estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger states.

As Ramadan calls for purposeful living and wise decisions, Adron Homes is redefining the season, transforming reflection into investment and faith into a lasting legacy.

News

Ramadan: Adron Homes Felicitates Muslims, Preaches Hope and Unity

Ramadan: Adron Homes Felicitates Muslims, Preaches Hope and Unity

Adron Homes & Properties Limited has congratulated Muslim faithful on the commencement of the holy month of Ramadan, urging Nigerians to embrace the virtues of sacrifice, discipline, and compassion that define the season.

In a statement made available to journalists, the company described Ramadan as a period of deep reflection, spiritual renewal, and strengthened devotion to faith and humanity.

According to the management, the holy month represents values that align with the organisation’s commitment to integrity, resilience, and community development.

“Ramadan is a time that teaches patience, generosity, and selflessness. As our Muslim customers and partners begin the fast, we pray that their sacrifices are accepted and that the season brings peace, joy, and renewed hope to their homes and the nation at large,” the statement read.

The firm reaffirmed its dedication to providing affordable and accessible housing solutions to Nigerians, noting that building homes goes beyond structures to creating environments where families can thrive.

Adron Homes further urged citizens to use the period to pray for national unity, economic stability, and sustainable growth.

It wished all Muslim faithful a spiritually fulfilling Ramadan.

Ramadan Mubarak.

News

Valentine Season: Adron Homes Encourages Nigerians to Build Lasting Love Through Real Estate

Valentine Season: Adron Homes Encourages Nigerians to Build Lasting Love Through Real Estate

Adron Homes and Properties has continued its ongoing “Love for Love Promo” as part of its Valentine season initiatives, encouraging couples, families, and investors to move beyond traditional gifts by embracing shared property ownership as a lasting expression of commitment and financial stability.

The company stated that the promo, which has been running throughout the Valentine period, was designed to inspire Nigerians to build long-term value and legacy through real estate investments. It noted that the initiative offers attractive discounts, flexible payment options, and a variety of exclusive gift items across its estates and housing projects nationwide.

Under the promo structure, clients who pay ₦100,000 receive cake, chocolates, and a bottle of wine, while those who pay ₦200,000 receive a Love Hamper. Subscribers who commit ₦500,000 receive a Love Hamper with cake, and those who pay ₦1,000,000 enjoy a choice of a Samsung phone or a Love Hamper with cake.

The incentives increase with higher commitments. Clients who pay ₦5,000,000 receive either an iPad or a romantic couple’s getaway at a top Nigerian hotel, while payments of ₦10,000,000 come with options including a Samsung Z Fold 7, a three-night stay at a premium resort, or a full solar power installation.

High-value investors are also rewarded, as clients who pay ₦30,000,000 on land receive a three-night couple’s trip to Doha or South Africa. At the same time, purchasers of houses valued at ₦50,000,000 are presented with a double-door refrigerator, further reflecting the company’s focus on combining lifestyle experiences with strategic investments.

The company added that the promo covers estates located in Lagos, Shimawa, Sagamu, Atan–Ota, Papalanto, Abeokuta, Ibadan, Osun, Ekiti, Abuja, Nasarawa, and Niger states. It reiterated its commitment to secure land titles, affordable pricing, and prime locations, urging Nigerians at home and in the diaspora to take advantage of the ongoing Valentine campaign to build a future rooted in love, security, and prosperity.

-

News10 months ago

News10 months agoRERAPAN Celebrates Babatunde Adeyemo at 46

-

News9 months ago

News9 months agoReal Estate Achievers Awards and Exhibition 2025 (REAA)

-

Real Estate Achievers Awards10 months ago

Real Estate Achievers Awards10 months agoReal Estate Achievers Awards and Exhibition 2025

-

News10 months ago

News10 months agoLand Prices in Lekki, Ajah, and Ikoyi: A 2025 Guide for Investors

-

Interviews2 years ago

Interviews2 years agoGoogle hit with record EU fine over Shopping service

-

Mortgage finance10 months ago

Mortgage finance10 months agoComparing Nigerian Mortgage Structures to Global Standards mortgage

-

News9 months ago

News9 months agoRepton Group wins Dangote Cement National Largest Distributor Award

-

Real Estate insurance2 years ago

Real Estate insurance2 years agoThe full story of Thailand’s extraordinary cave rescue